us dollar charts

As Zoltan Pozsar of Credit Suisse warned a couple of weeks ago, the combination of a glut of safe assets in the market, plus a Fed still intent on keeping monetary policy tight, has been feeding through to repo markets in the form of volatility.

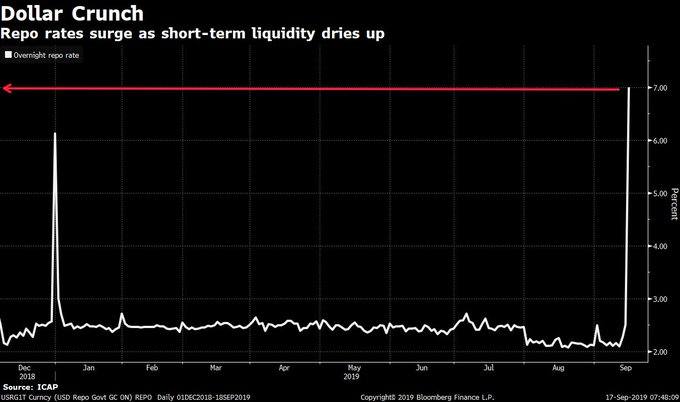

But now we have this (hat tip to Marc Ostwald from ADMISI for the chart):

That’s a relatively wild spike in US general collateral repo rates to as much as 8.25 per cent at the open, at a bid/offer spread of 9.0%/7.50%.

This is seismic stuff — and possibly indicative of a real dollar crunch — not least because it’s not even the quarter’s end (the usual time funding squeezes emerge).

Therefore something else must be driving the dash for cash.

Repo focused analysts such as TD Securities’ Priya Misra and Gennadiy Godberg note the market is blaming a combination of things including the corporate tax date (which creates a demand for liquidity), bill supply, coupon settlements and GSE cash as potential reasons for the spike.

But since much of that should already have been priced in — and this is the third time repo rates have spiked to abnormally high rates the past year — they, in line with Pozsar’s thinking, are blaming structural factors. And, in particular, a general scarcity of bank reserves:

Reserves have been declining since 2014 and we expect them to decline further as Treasury's cash balance increases and currency in circulation grows. The spike in repo affects the transmission of monetary policy and we expect the Fed to take the spike in repo rates seriously. A standing repo facility can greatly help, but we don't think that the operational details have been sorted out yet. An IOER cut or limiting the foreign reverse repo facility will only help at the margin.

While all of that is probably true, it still doesn’t add much insight on what the real trigger for the repo spike has been.

Alphaville has one highly speculative theory, which we invite more informed readers to scrutinise and debunk if needs be. (Although, our readers never require much invitation.)

We previously argued Monday’s oil price spike constituted a pretty unprecedented state of affairs and could conceivably lead to a lot of fallout for those caught on the wrong side of the move — evidence of which would only come to light in the days to come.

So one theory is that a dash to post variation margin at the respective commodity exchanges (and in cleared bilateral markets as well) is in some ways feeding through to a funding shortfall in repo markets.

As we noted previously, a lot of the buyside were likely caught short due to the seemingly popular theory that the trade war would lead to a slowdown in oil demand.

Even if such funds closed down their positions entirely, yesterday’s move was so large it is more than likely initial margins might have been blown through entirely, leaving many exposed to raising the difference owed to the exchanges elsewhere (under legal obligation).

But the other bigger theory is that the strikes have taken out approximately $400m in daily dollar cash income for the Saudi government. That income equals dollar liquidity the Saudis suddenly no longer have access to. Their dollar spending commitments, however, go unchanged. If commitments to pay salaries and suppliers can’t be met by (what were until now fairly predictable) cash injections from oil sales, the only other option for the Saudis is to start liquefying their dollar asset reserves . . . and that, very likely, is something to be conducted through the repo markets directly.

In which case repo markets may be moving in anticipation of Saudi liquidity operations — in the context of a market that’s already being over supplied in terms of safe government bond assets relative to available bank reserve liquidity — or as a result of them already taking place.

Opinions and counter theories welcome below. We’d be especially keen to hear what repo market practitioners are seeing and hearing.

The Fed is already taking action. Here’s the NY Fed’s latest statement:

In accordance with the FOMC Directive issued July 31, 2019, the Open Market Trading Desk (the Desk) at the Federal Reserve Bank of New York will conduct an overnight repurchase agreement (repo) operation from 9:30 AM ET to 9:45 AM ET today, September 17, 2019, in order to help maintain the federal funds rate within the target range of 2 to 2-1/4 per cent.This repo operation will be conducted with Primary Dealers for up to an aggregate amount of $75 billion. Securities eligible as collateral in the repo include Treasury, agency debt, and agency mortgage-backed securities. Primary Dealers will be permitted to submit up to two propositions per security type. There will be a limit of $10 billion per proposition submitted in this operation. Propositions will be awarded based on their attractiveness relative to a benchmark rate for each collateral type, and are subject to a minimum bid rate of 2.10 per cent.

Scratch that! The operation has been cancelled due to technical difficulties. It’s all getting a bit crazy. (Let’s hope they weren’t using blockchain).

It’s been a while since we checked in on what’s percolating through the mind of financial-plumbing specialist Zoltan Pozsar at Credit Suisse. And it looks like this was an error because we may have missed a whopper of a dollar funding story.

Here’s the gist from the opening of his latest note (with our emphasis, oh, and RRP stands for reverse repurchase agreement):

The FOMC should forget about r* for the moment and focus on Sagittarius-A* – the supermassive black hole at the center of global dollar funding markets.The black hole is the foreign RRP facility, which has seen close to $100 billion of inflows since the beginning of the year.The driver of these inflows is the curve inversion, and the longer the inversion persists the more inflows will follow. The trade war is also contributing to the inflows – given the inversion, as foreign central banks weaken their currencies they “buy” the foreign RRP facility and not Treasuries like in the past.Foreign central banks are rate shopping… …and an uncapped foreign RRP facility is what enables that. Like the matter that enters a black hole, the reserves that are sterilized by the foreign RRP facility are gone for good – like the reserves “shredded” via taper.

It’s an important point because even if the Fed were to stop tapering (a monetary tightening measure which sees central banks absorbing the proceeds of maturing Treasuries rather than reinvesting them in further asset purchases), tightening would continue for as long as the uncapped foreign RRP facility attracts inflows. Which it would, says Pozsar, because of the curve inversion.

He predicts such inflows could eclipse $200bn by the year’s end with the consequence of pricing Treasury supply out of the market.

This suggests the Fed may have overdone its hiking cycle, something that now can only be fixed with rate cuts. (Which incidentally also means, eek, Donald Trump might be right about Powell’s policy.)

Key to this conclusion is how the make-up of inflows into the foreign RRP facility has been changing over time. In 2015, for example, much of the growth of the facility was due to inflows from Japan’s Ministry of Finance.

As Pozsar explains:

As Pozsar explains:

...the Fed, deeply concerned that it won’t be able to enforce a floor underneath o/n interest rates as it tries to exit ZIRP, uncapped the facility to help banks shed balance sheet by luring foreign central banks away from banks and into the foreign RRP facility, and to help ease the bill shortage in money markets by luring foreign central banks out of bills and into the foreign RRP facility.

The important context at the time was the massive shortage of short-term safe assets in the system, which put negative pressure on short-end rates across the board. By diverting central bank liquidity away from commercial banks and over to the foreign RRP facility, the Fed thus released important bill supply into the market which alleviated that pressure and thus defended the rate floor.

The rate-hiking cycle, however, has entirely reversed this situation.

RRP inflows are now being fuelled not by balance sheet constraints or a shortage of quality collateral but the inverse: intraday liquidity constraints and a collateral surplus.

In short, there are too many dollar-denominated safe assets in the market and not enough liquidity and hence -- very possibly -- the makings of a fresh liquidity crisis.

As Pozsar explains:

Because inflows into the facility sterilize reserves and add collateral to the financial system, they worsen the collateral surplus. But don’t blame the foreign central banks placing cash into the facility, for they do what a rational person would do when offered something that has value – take as much of the stuff as they can, while they can.

Pozsar adds the current inversion is the most extreme relative to overnight repo rates, and that historically this is the first time that the curve has inverted relative to these rates:

The usual structural incentive during a yield curve inversion is to sell long-term notes and buy short-term bills. This time, however, the greater incentive is to sell long-term notes and buy the foreign RRP facility, not bills. Thus the worse the inversion gets , the more dollar they’ll put at the foreign RRP facility. This incidentally ensures the short-term bill market doesn’t receive the offsetting flows it should.

But there’s more!

Conventionally, central banks that want to weaken their currencies relative to the dollar intervene by buying dollars and investing in Treasuries. But the recent interventions by the PBoC seem to have seen dollars invested in the foreign RRP facility as well as in Treasuries, says Pozsar.

Every penny that flows into the facility, he says, makes it harder for banks to fund dealers, whose safe-assetinventories are growing partly due to the foreign RRP facility, and partlydue to the circularity of the matter:

…economists would refer to the above dynamics as pro-cyclical: more collateral supply, higher repo rates, more inflows into the foreign RRP facility, even more collateral supply.

Which we guess means the Fedshould cap or otherwise restrict the facility and begin to lower rates to avoid a major dollar funding squeeze.

But why might they not do this? One reason, says Pozsar, is that other central banks don’t cap their equivalent facilities, and the other is that the Fed is not the only one to be paying a better rate on its facility than can be achieved in local bill markets.

According to Pozsar this is the result of strategic BoJ and ECB policy designed to encourage the lending of more dollars in the FX swap market, so as to avoid deeply negative reinvestment yields and make more bills available in their own financial systems.

But it makes no sense for the Fed to do the same, he says. To the contrary doing so creates a paradox of thrift.

The following is a stellar point by Pozsar:

If the global financial system’s problem is a shortage of US dollars, it makes sense for foreign central banks to pull funds away from their local bill markets to help improve the reinvestment returns of dollar lenders and hence ease the flow of dollars, but it makes no sense for the Fed to do the same – if it does, it hurts the flow of dollars. Here is how… If the Fed offers a rate above Treasury bill yields on an uncapped the foreign RRP facility, it will attract inflows. Inflows sterilize reserves and increase collateral supply on the margin – instead of buying Treasury bills at auctions, the facility incentivises foreign central banks to deposit cash at the Fed. These dynamics put an upward pressure on local bill yields, and higher local bill yields reduce the allure of lending dollars in the FX swap market – the flow of dollars suffers and the Fed is pushing against the efforts of other central banks.

So, unless the Fed takes action -- and by that Pozsar doesn’t mean technical action such as the creation of a standing repo facility or asset purchases -- the collateral tsunami may continue to worsen.

It follows, Pozsar says, that if the Fed priced supply out of the market, it should now consider rate cuts instead: ”...rate cuts that are aggressive enough to re-steepen the curve so that dealer inventories can clear; cuts deep enough to incentivise real-money investors to lend long, not short and foreign investors to buy Treasuries on an FX hedged basis on scale again.”

That makes this weekend’s Jackson Hole meeting arguably the most significant in a decade, concludes Pozsar.

Comments

Post a Comment